Precious metals have always been recognized as valuable, as their name clearly portraits it. Their value is especially significant in times of crises, such as war, political or economic. Unfortunately, we are all aware that all of them are constantly present throughout the world, which makes investment in precious metals always a current topic. However, it is not as simple as preparing a sum of money and buying some precious metal for safety. Investing in precious metals is a complex process; let us cover everything you need to know about it.

Gold

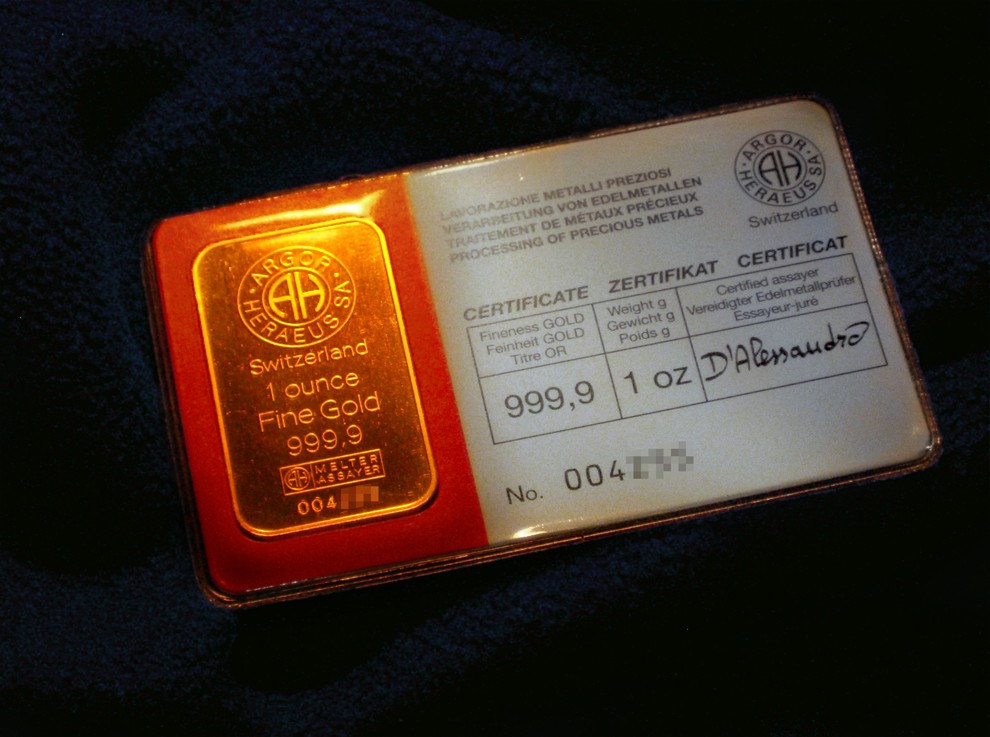

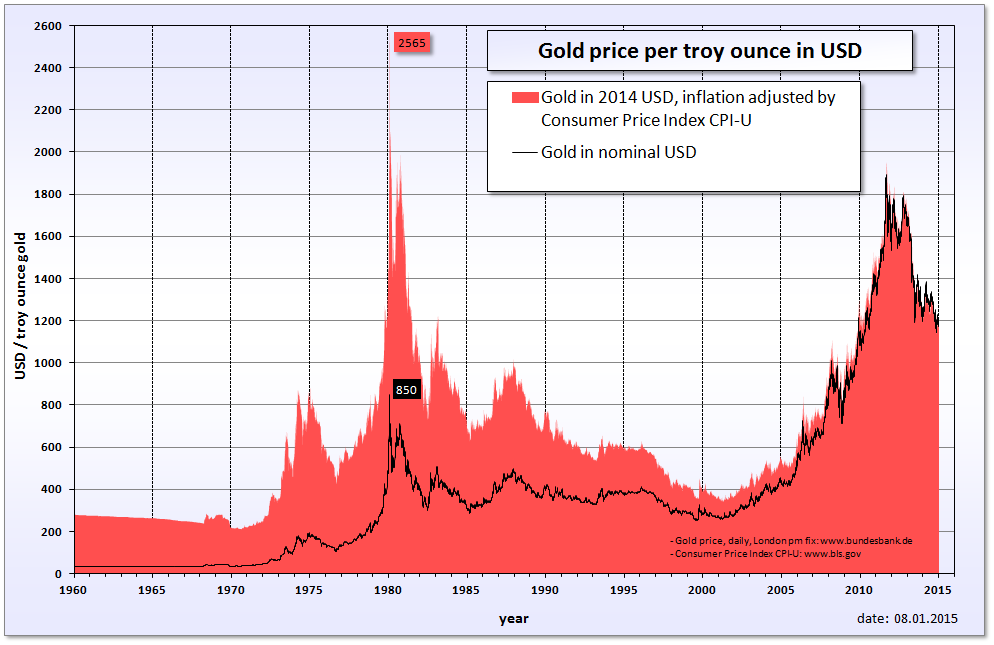

Gold’s unique durability has made it a sought after material since the dawn of time. Although it has industrial applications, dentistry and electronics in particular, it is best known and mostly used in jewelry production, as well as a currency. The price of gold is determined on a daily basis. In turmoil times it is increasingly sought after as a means of safety. For example, if there are any local or global financial concerns of such proportions that banks and money are deemed as unstable, the price of gold rises since the demand for it increases. In times of inflation, it is desired as an asset whose value is constant and even increased. Lastly, in war time conditions, it is always more convenient to have all your savings or property turned into the form of 100 oz gold bars that can be conveniently carried and traded or sold whenever and wherever needed.

Silver

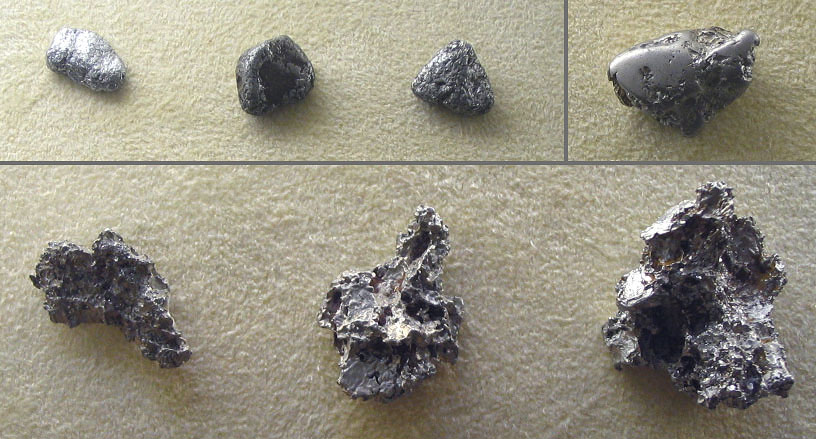

Compared to gold, price fluctuations of silver are more volatile. The main reason for this is the fact that the silver is perceived as both a store of value and an industrial metal, particularly in battery industry and superconductor and microcircuit applications. What this means in practice is that the price of silver may fluctuate significantly, especially if compared to gold. Therefore, investing in silver can be both very beneficial and utterly devastating, all depending on the purchase and sale timing.

Platinum

Platinum is the third on the list of precious metals worth investing in. It is regularly traded throughout the world and is usually of higher value than gold in times of political and financial stability. Just like silver, its price is determined by industrial use as well. Platinum is used in auto and computer industry, jewelry production and petroleum and chemistry refineries. All of the above makes platinum the most volatile of all precious metals, which means that a special care is required when investment timing is concerned.

Investment Options

There are several investment options and which should be chosen depends solely on your level of expertise, future plans and current conditions. For example, golden certificates are of equal benefit as physical gold ownership without having to think about storage. However, in times of real physical danger, such as war, they will be rough to trade for practical goods. On the other hand, Exchange traded funds are a convenient worldwide accepted manner of buying and selling precious metals. Investing in stock and mutual funds that have shares in mining companies is another option, particularly when it comes to silver and platinum. Lastly, buying antique coins and newly minted ones is also an established and practical investment option, especially when storage options are limited.

Do not overinvest

Due to precious metals volatile nature, investment in them should be seen as leverage for other investments and savings and way of securing your future for possible dire situations. What this also means is that your precious metal investments need to be counterbalanced with other type of investment in case something drastic happens at the precious metals market. In other words, do not overinvest in them in order not to endanger your present and future financial stability.

To sum up, investing in precious metals is all about proper judgment, timing and leaves no room for hazardousness. If you feel you fit the profile or trust a professional that does, give it a serious thought and by all means start small.