Writing a hardship letter can seem like a difficult task, but once you know the proper elements to include in one, you can master this type of letter. […]

Finance

Posted on:

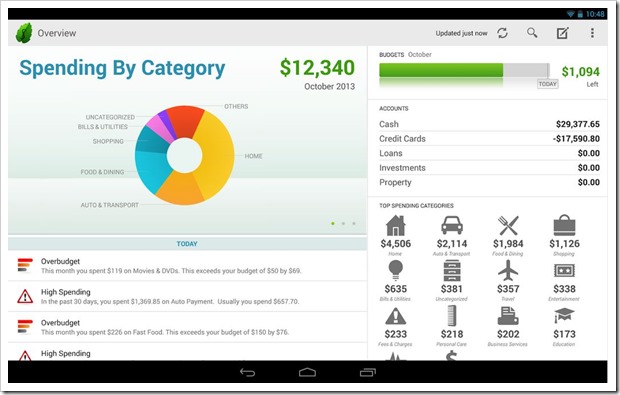

Must-Have Personal Finance Apps On Android

There are more personal finance apps available for Android than ever before, so it’s important to sift through and find out which are best for meeting your personal […]